We Specialize in Investing in Multifamily Communities

We have been able to deliver outsized returns over the years because we have put in place the elements that are critical for success in multifamily housing: an experienced leadership team, a research operation that directs us to the best properties in the best markets, a focus on protecting downside risk and an approach to customer service that translates to an excellent resident experience. Our residents love to call our communities home. It all adds up to a model that will continue to work well into the future.

White Oak Differentiators

Investing in multifamily throughout cycles and our deep data analysis help us identify the parts of the market that are poised for growth.

We have developed the talent, resources and systems to maintain our quality and culture as we grow.

Our founder is building his second successful multifamily business alongside a leadership team with an average of 25 years of experience.

We actively invest in systems and research tools that make us more informed investors and provide us with a competitive edge.

Our team is comprised of experienced professionals who bring perspectives and experience from inside and outside the multifamily industry.

Our financial strength and the trust we have earned from our investment partners allow us to move quickly when we see attractive opportunities.

Alignment of Interest with Investors

- We are steadfast in our mission to outperform the market and our combination of data driven decision making, market expertise, and flexibility allow us to do just that.

- We have delivered strong and consistent returns throughout our history.

- We know there is value in having “skin in the game” and we invest our own capital alongside our partners on each acquisition.

- Our disciplined approach allows us to drive investment results when attractive market opportunities and conditions arise.

Research Is In Our DNA

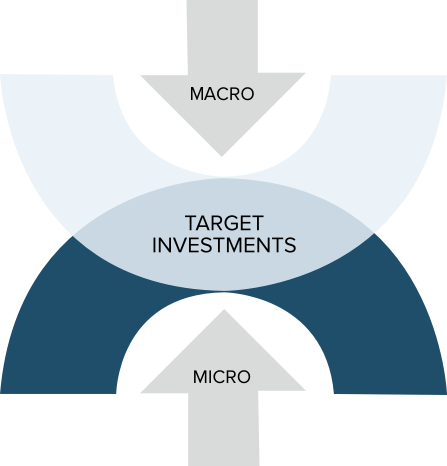

At White Oak Partners, research is more than just a department: it is the key to solving problems and managing risk. We have a dedicated research team that vets each investment opportunity from both a top-down and bottom-up perspective. In a knowledge economy, we regard our research as a critical competitive advantage.

- We actively assess the economic landscape and multifamily fundamentals to select our target markets.

- Our disciplined approach to underwriting focuses on the granular analysis of our property performance helps maximize investor returns.

- We use our experience to assess relative value and identify assets that are underpriced.

Our Investment Partners

Our investors include a large state pension plan, major insurance companies and global asset managers who value our specialization to manage their multifamily investments.